Howard Marks put it properly when he mentioned that, fairly than worrying about share worth volatility, ‘The opportunity of everlasting loss is the danger I fear about… and each sensible investor I do know worries about.’ It is solely pure to contemplate an organization’s steadiness sheet whenever you look at how dangerous it’s, since debt is commonly concerned when a enterprise collapses. We notice that Adobe Inc. (NASDAQ:ADBE) does have debt on its steadiness sheet. However the extra vital query is: how a lot danger is that debt creating?

What Threat Does Debt Convey?

Debt is a device to assist companies develop, but when a enterprise is incapable of paying off its lenders, then it exists at their mercy. Within the worst case state of affairs, an organization can go bankrupt if it can’t pay its collectors. Whereas that’s not too widespread, we frequently do see indebted firms completely diluting shareholders as a result of lenders power them to boost capital at a distressed worth. In fact, loads of firms use debt to fund progress, with none damaging penalties. Step one when contemplating an organization’s debt ranges is to contemplate its money and debt collectively.

Take a look at our newest evaluation for Adobe

What Is Adobe’s Web Debt?

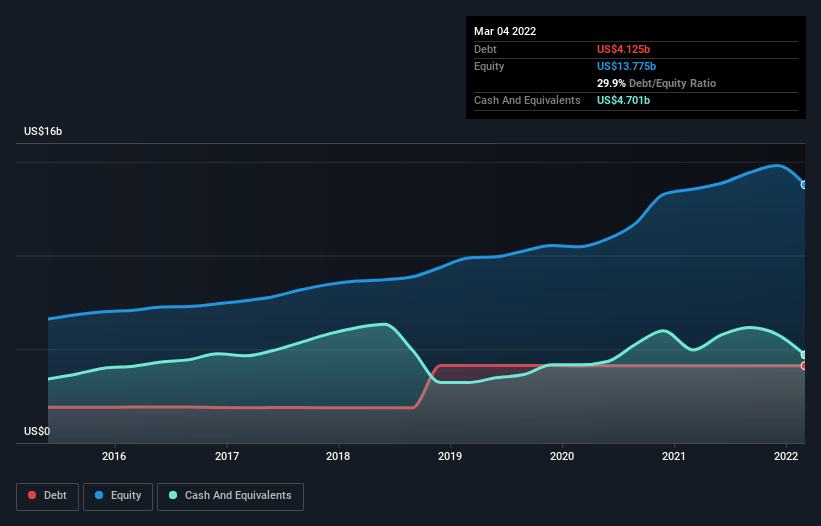

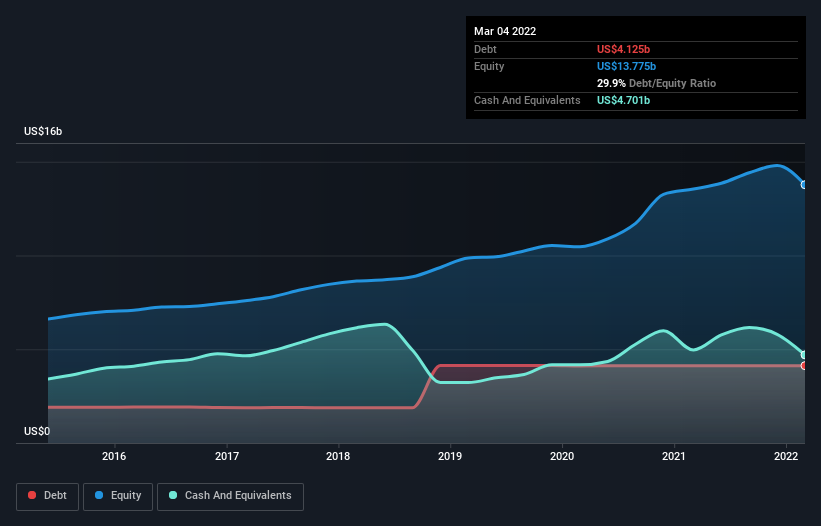

As you possibly can see under, Adobe had US$4.13b of debt, at March 2022, which is about the identical because the yr earlier than. You’ll be able to click on the chart for better element. However however it additionally has US$4.70b in money, resulting in a US$576.0m internet money place.

How Wholesome Is Adobe’s Steadiness Sheet?

Zooming in on the most recent steadiness sheet information, we will see that Adobe had liabilities of US$7.20b due inside 12 months and liabilities of US$5.00b due past that. Offsetting this, it had US$4.70b in money and US$1.69b in receivables that have been due inside 12 months. So it has liabilities totalling US$5.82b greater than its money and near-term receivables, mixed.

In fact, Adobe has a titanic market capitalization of US$185.7b, so these liabilities are in all probability manageable. Having mentioned that, it is clear that we should always proceed to observe its steadiness sheet, lest it change for the more serious. Regardless of its noteworthy liabilities, Adobe boasts internet money, so it is truthful to say it doesn’t have a heavy debt load!

Additionally constructive, Adobe grew its EBIT by 25% within the final yr, and that ought to make it simpler to pay down debt, going ahead. When analysing debt ranges, the steadiness sheet is the apparent place to begin. However it’s future earnings, greater than something, that can decide Adobe’s skill to take care of a wholesome steadiness sheet going ahead. So if you wish to see what the professionals assume, you may discover this free report on analyst revenue forecasts to be fascinating.

Lastly, a enterprise wants free money movement to repay debt; accounting earnings simply do not lower it. Whereas Adobe has internet money on its steadiness sheet, it is nonetheless price looking at its skill to transform earnings earlier than curiosity and tax (EBIT) to free money movement, to assist us perceive how rapidly it’s constructing (or eroding) that money steadiness. Fortunately for any shareholders, Adobe truly produced extra free money movement than EBIT over the past three years. That kind of robust money conversion will get us as excited as the gang when the beat drops at a Daft Punk live performance.

Summing up

Whereas it’s at all times smart to have a look at an organization’s complete liabilities, it is rather reassuring that Adobe has US$576.0m in internet money. And it impressed us with free money movement of US$6.8b, being 119% of its EBIT. So is Adobe’s debt a danger? It would not appear so to us. There is no doubt that we be taught most about debt from the steadiness sheet. Nonetheless, not all funding danger resides inside the steadiness sheet – removed from it. For instance – Adobe has 2 warning indicators we predict you need to be conscious of.

When you’re enthusiastic about investing in companies that may develop earnings with out the burden of debt, then take a look at this free listing of rising companies which have internet money on the steadiness sheet.

Have suggestions on this text? Involved concerning the content material? Get in contact with us immediately. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We intention to convey you long-term centered evaluation pushed by basic information. Be aware that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.