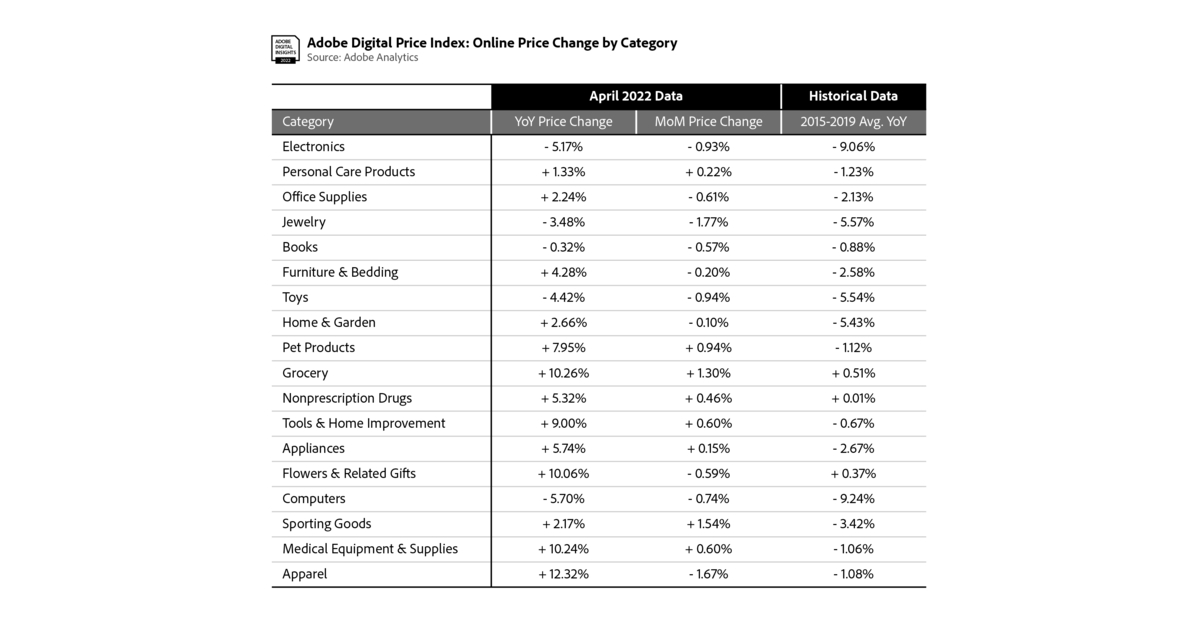

SAN JOSE, Calif.–(BUSINESS WIRE)–Adobe (Nasdaq:ADBE) right this moment introduced the newest on-line inflation information from the Adobe Digital Worth Index (DPI), powered by Adobe Analytics. In April 2022, on-line costs elevated 2.9% year-over-year (YoY), down from the document 3.6% YoY enhance in March – a lower of 0.5% month-over-month (MoM). Whereas this marks the 23rd consecutive month of inflation on-line YoY, April exhibits early indicators of on-line worth will increase starting to gradual. Over half of the classes tracked by the DPI (10 out of 18) noticed MoM worth decreases in April.

Costs for electronics have been down 5.2% YoY (down 0.9% MoM), a document YoY low for the class during the last 12 months. Costs for attire elevated 12.3% YoY, whereas reducing 1.7% MoM. Though that is the very best YoY enhance of any class, it’s down from latest highs (February at 16.7% YoY and March at 16.3% YoY). Costs haven’t eased for groceries, rising 10.3% YoY (up 1.3% MoM) in addition to pet merchandise, which rose 8.0% YoY (up 0.9% MoM), document YoY highs for each classes.

In April, shoppers spent $77.8 billion on-line, which represents modest development at 4.5% YoY. On-line spending within the U.S. grew double digits at 12.2% YoY ($71 billion) in January and 15.5% ($67 billion) in February. Client spending in April can be under the $83.08 billion spent in March, representing a 6.8% decline MoM or $5.28 billion. With rising rates of interest and chronic inflation, shoppers have pulled again on spending for sturdy items.

“As the price of borrowing and financial uncertainty rises for shoppers, we’re starting to see the early affect on each on-line inflation and spend,” mentioned Patrick Brown, vice chairman of development advertising and insights, Adobe. “Nevertheless, sturdy demand for e-commerce nonetheless drove over $77 billion in spend final month, as shoppers proceed to embrace the benefit of on-line purchasing and extra personalised buyer experiences within the digital economic system.”

The DPI offers essentially the most complete view into how a lot shoppers pay for items on-line. Powered by Adobe Analytics, it analyzes one trillion visits to retail websites and over 100 million SKUs throughout 18 product classes: electronics, attire, home equipment, books, toys, computer systems, groceries, furnishings/bedding, instruments/house enchancment, house/backyard, pet merchandise, jewellery, medical tools/provides, sporting items, private care merchandise, flowers/associated presents, non-prescription drug and workplace provides.

In April, 13 of the 18 classes tracked by the DPI noticed YoY worth will increase, with attire rising essentially the most. Worth drops have been noticed in 5 classes: electronics, jewellery, books, toys and computer systems.

Eight of the 18 classes within the DPI noticed worth will increase MoM. Worth drops have been noticed throughout 10 classes together with electronics, workplace provides, jewellery, books, furnishings/bedding, toys, house/backyard, flowers/associated presents, computer systems and attire.

Notable classes within the Adobe Digital Worth Index for April:

- Electronics: Costs have been down 5.2% YoY (down 0.9% MoM). That is the most important YoY drop for the class since November 2020 (In October 2020, costs have been down 6.2% YoY). As the most important class in e-commerce by share of spend, worth actions have an outsized affect on general inflation on-line.

- Computer systems: Costs have been down 5.7% YoY (down 0.7% MoM). That is the 16th consecutive month of deflation for the class, after rising 2.9% YoY in December 2020. The value lower remains to be under historic ranges, nonetheless, with laptop costs dropping 9.2% YoY on common (from 2015 to 2019).

- Attire: Costs have been up 12.3% YoY (down 1.7% MoM). Whereas the class has now seen over a 12 months of on-line inflation (13 months), there are indicators that costs are starting to ease. From November 2021 to March 2022, costs elevated by greater than 15.7% YoY every month, properly above the 12.3% YoY in April.

- Groceries: Costs continued to surge and rose 10.3% YoY (up 1.3% MoM), setting one other new document on an annual foundation. This follows a 9.0% YoY enhance in March, a 7.6% YoY enhance in February and a 5.8% YoY enhance in January—all document highs. Groceries stays the one class to maneuver in lockstep with the CPI on a long-term foundation, with on-line costs rising now for 27 consecutive months.

- Pet Merchandise: Costs have been up 8.0% YoY (up 0.9% MoM), the very best enhance for the class YoY. On-line inflation for pet merchandise has now been noticed for 2 full years, with the earlier excessive level in September 2020 (up 7.8% YoY).

Methodology

The DPI is modeled after the Client Worth Index (CPI), printed by the U.S. Bureau of Labor Statistics and makes use of the Fisher Worth Index to trace on-line costs. The Fisher Worth Index makes use of portions of matched merchandise bought within the present interval (month) and a earlier interval (earlier month) to calculate the worth modifications by class. Adobe’s evaluation is weighted by the actual portions of the merchandise bought within the two adjoining months.

Powered by Adobe Analytics, Adobe makes use of a mix of Adobe Sensei, Adobe’s AI and machine studying framework, and handbook effort to section the merchandise into the classes outlined by the CPI handbook. The methodology was first developed alongside famend economists Austan Goolsbee and Pete Klenow.

About Adobe

Adobe is altering the world by digital experiences. For extra info, go to www.adobe.com.

© 2022 Adobe. All rights reserved. Adobe and the Adobe brand are both registered emblems or emblems of Adobe in the USA and/or different nations. All different emblems are the property of their respective house owners.