Sundry Pictures/iStock Editorial by way of Getty Photos

Thesis

Adobe (NASDAQ:ADBE) is a chief in digital media software program in a world that continues to change into extra digital. I consider Adobe has a powerful moat due to the main software program they provide as part of their Inventive Cloud and Doc Cloud segments. In my view, subscription-related revenues from Inventive Cloud functions protected by excessive switching prices and PDF community results will assist ventures into new, probably excessive progress areas. With the potential assist from Inventive Cloud ARR (annual recurring income) and excessive PDF adoption, Adobe could proceed creating newer merchandise and platforms like Adobe Signal, Adobe Sensei (AI providers), and the Adobe Expertise Cloud. By making a holistic suite of product choices constructed on high of their presently extensively used platforms/functions, I consider Adobe’s gross sales power can entice new clients whereas getting present ones to consolidate their software-based workflows onto Adobe merchandise.

I consider Adobe is a staple firm with a number of flagship merchandise like Photoshop and PDF which might be often used as verbs. With the inventory presently 44% off highs and buying and selling on the backside of a decade-long P/E vary, entry into this trade chief with strong progress prospects could also be glorious.

Background

Breaking down Adobe’s enterprise by the three segments they report in is the best solution to perceive the enterprise for my part.

Digital Media

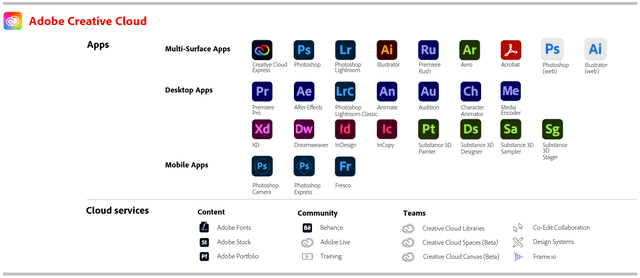

- The digital media section is damaged up into two important sub-segments; Adobe Inventive Cloud and Adobe Doc Cloud. Adobe Inventive Cloud is a subscription service that grants customers entry to cloud-based functions:

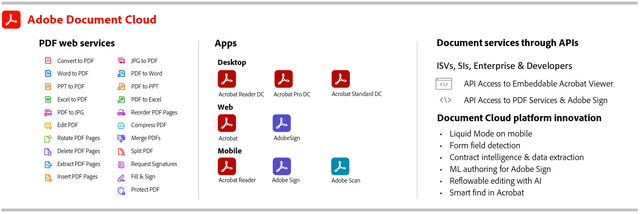

- Purposes accessible on Adobe Doc Cloud are beneath:

Digital Expertise

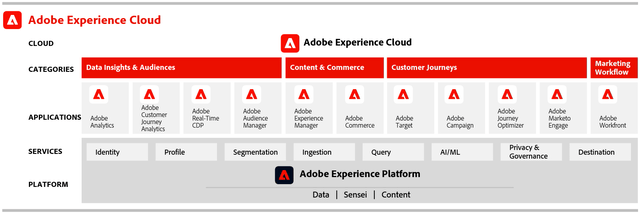

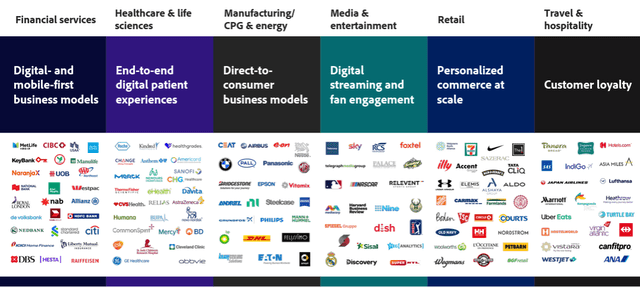

The Adobe Expertise Cloud is an built-in platform containing functions that serve clients with instruments and providers aimed to optimize analytics and commerce. Clients for the digital expertise suite embrace entrepreneurs, advertisers, businesses, publishers, merchandisers, retailers, net analysts, knowledge scientists, and builders.

The Adobe Expertise Platform intends to supply companies and types with a sturdy system to rework buyer knowledge into buyer profiles that replace in real-time utilizing synthetic intelligence to personalize the patron’s expertise.

The particular options and merchandise inside Adobe Expertise are beneath:

- Information Insights & Audiences: Adobe Analytics, Adobe Expertise Platform, Buyer Journey Analytics, Adobe Viewers Supervisor, and Actual-time Buyer Information Platform.

- Content material & Commerce: Adobe Expertise Supervisor.

- Buyer Journeys: Marketo Have interaction, Adobe Marketing campaign, Adobe Goal, and Journey Optimizer.

- Advertising Workflow: Adobe Workfront.

Publishing and Promoting

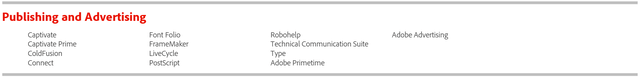

That is Adobe’s smallest section and is damaged up into two components:

- Adobe Promoting Cloud: Delivers an end-to-end platform for managing adverts throughout digital codecs.

- Legacy Publishing Merchandise: License their expertise to OEMs that manufacture workflow software program, printers, and different output units.

All the Adobe merchandise I listed are centralized on their web site at Adobe.com and if you wish to examine every product in-depth, web page 9 of their most up-to-date 10-Okay is a superb begin.

Adobe

Thesis Assist

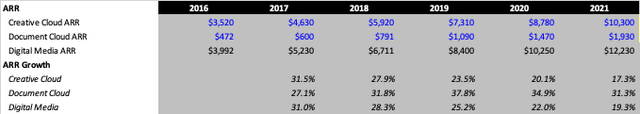

The assist from Adobe Inventive Cloud is a key a part of my thesis as a result of I consider it is going to complement youthful and probably excessive progress areas of Adobe’s enterprise. Adobe Inventive Cloud has grown considerably over the previous decade as Photoshop and different functions on the platform have change into staples in digital media. During the last 5 years, Inventive Cloud and whole digital media ARR have compounded at 24% and 25%, respectively:

Although Adobe would not instantly report its internet greenback retention price [NRR], I consider it’s honest to imagine NRR has been over 120% over the previous 5 years as a result of ARR has sustained 20% progress each year. Additionally, administration is guiding for an extra $440 million internet new ARR for the digital media section in Q2, representing 5.3% progress QoQ partially pushed by new specific web-based merchandise and explosive demand for video content material.

Doc Cloud progress has additionally been distinctive, pushed by accelerating PDF productiveness together with enhancing, changing, sharing, scanning, and signing. In Q1 ’22, Doc Cloud progress was 29% YoY. With trillions of PDF recordsdata on the market and billions extra being created day by day, I consider PDF monetization remains to be younger. Due to the mass utilization charges and community results concerned with PDF, I consider Adobe will have the ability to proceed rising earnings within the Doc Cloud section, particularly with program additions like Adobe Signal.

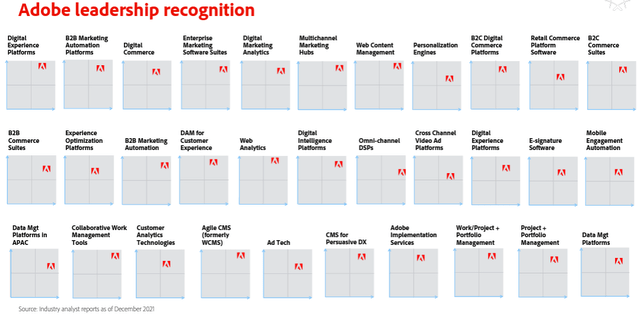

I consider the soundness (and future progress) in digital media earnings will proceed driving product innovation and management of their respective areas of operation. Adobe’s management profile is already spectacular in keeping with trade analyst studies however I consider progress within the Expertise Cloud, AI workloads, and packages like Adobe-Signal will drive not solely additional management however earnings for the corporate.

Financials

Mannequin Highlights

Some notes earlier than sharing my mannequin:

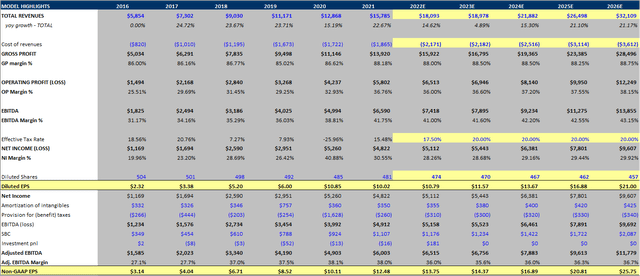

- I forecast a pointy slowdown in top-line progress in FY ’23 due principally to income cyclicality related to a possible financial slowdown. Not attempting to convey an excessive amount of macro into my forecasts however needed to remain conservative.

- Administration nonetheless forecasting mid-teens income progress and 100%+ NRR for the yr.

- I consider share repurchases will proceed to speed up with the inventory down and I’ve forecasted the diluted share rely to be down ~5% by FY ’26. As of the tip of Q1 ’22, the buyback program initiated in December 2020 nonetheless has $10.7 billion remaining of the $15 billion approved.

- In my view, Adobe’s digital media section will proceed driving the vast majority of whole earnings within the brief time period which can maintain margins elevated over the subsequent 5 years.

Created By Writer Utilizing Information From Adobe IR

Valuation

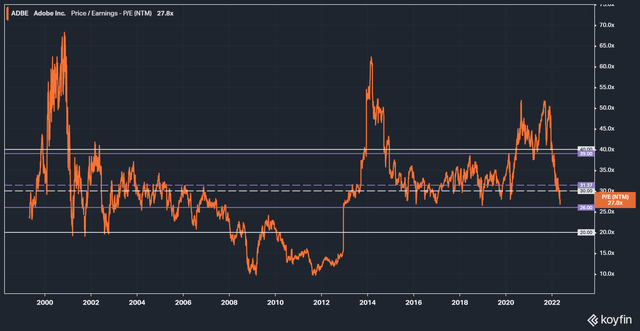

I consider Adobe inventory has traditionally traded between 20x and 40x NTM EPS for the reason that late 90s and over the previous decade has traded extra persistently between 26x and 39x NTM EPS. The channels I’ve drawn beneath keep away from occasions of peak valuation (tech bubble, 2014, and COVID-era) and despair (Nice Monetary Disaster/early restoration following):

(White strains symbolize my long-term channel and purple represents the final decade)

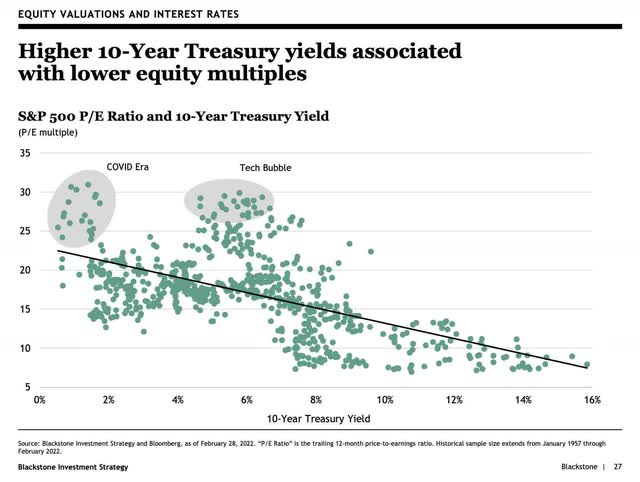

I consider the moat Adobe has constructed round its enterprise warrants the elevated valuation seen during the last decade but additionally understand the macro setting performs a job. Low rates of interest have probably supported larger multiples which could possibly be reversed transferring ahead.

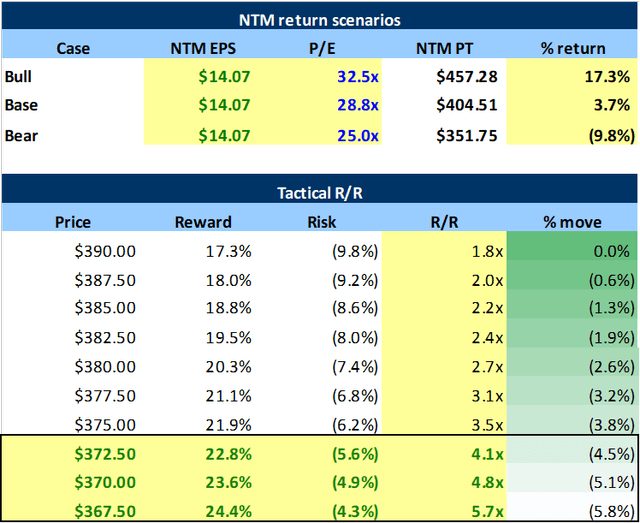

Worth Targets

Beneath are my subsequent twelve month [NTM] worth targets with a tactical threat to reward desk beneath:

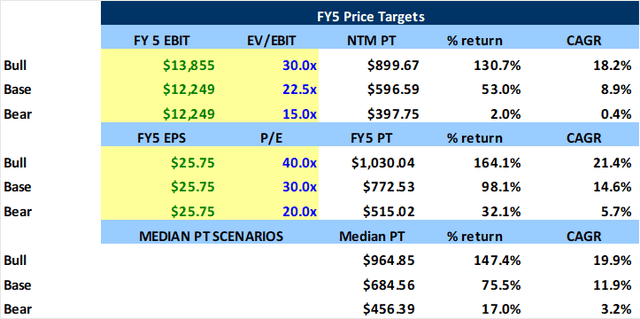

Beneath are my FY 5 PTs:

Dangers

Financial Cyclicality

I consider Adobe has a cyclical enterprise as a result of quite a lot of digital media and experience-related revenues are spurred by common enterprise exercise. As a result of Adobe performs an essential function in advertising and marketing for a lot of companies, if progress slows within the financial system, the potential for ARR churn from Adobe merchandise could also be seemingly.

I consider a mitigant to this threat lies inside Adobe’s big selection of clientele. Exterior of small companies or people utilizing the platform, Adobe additionally serves nearly each trade and sub-sector from the smallest to the biggest gamers. Current Doc Cloud enterprise buyer additions embrace Medallia (MDLA), Mercedes-Benz (OTCPK:DMLRY), Raytheon (RTX), Ricoh Europe (OTCPK:RICOY), Shimizu (OTCPK:SHMUY), and UnitedHealth (UNH). Q1 Expertise Cloud buyer additions embrace Crowdstrik (CRWD), Deutsche Telekom (OTCQX:DTEGY), IBM (IBM), Jaguar Land Rover (TTM), JPMorgan Chase (JPM), McDonald’s (MCD), and UnitedHealth (UNH).

Valuation Danger

Although I consider Adobe has wholesome progress prospects which will assist elevated valuations relative to the broad market, I do suppose the macro backdrop paints a stark image relating to potential a number of compression. Over the previous 20 years, Adobe has traded 29x NTM EPS on common. Previously 10 years, the typical NTM P/E was 35x. Whereas I consider Adobe has developed a wonderful moat, robust community results, and delivered robust earnings progress previously decade, I additionally am not blind to the very fact the rate of interest setting could have performed a key function.

Because the 10-yr Treasury yield continues to climb (+150 bps within the final twelve months), historic knowledge reveals that fairness valuations could also be topic to compression if yields proceed on their upward path.

Abstract

After buying and selling down ~44% from all-time highs, Adobe’s valuation is beginning to look extra enticing in my eyes. Given what I consider is a bearish macro backdrop which will have an effect on shares systematically, a inventory like Adobe buying and selling at 27x NTM EPS should still be in for a unstable journey. However for long-term centered traders, I consider Adobe is well-positioned for future progress as a powerful chief in digital media software program supported by a world persevering with to change into extra digital. Adobe nonetheless has unbelievable progress prospects with a diversified buyer base and product choices which will present further assist within the midst of turmoil market situations, for my part. After the inventory worth was nearly reduce in half during the last six months and is buying and selling beneath its historic valuation averages, Adobe could also be poised to indicate robust returns sooner or later to come back.