ermingut/iStock Unreleased by way of Getty Photographs

McDonald’s (NYSE:MCD) has introduced stable first quarter monetary figures. The agency’s world comparable gross sales had been up by 11.8%, primarily pushed by a powerful development of greater than 20% within the worldwide operated markets phase and an improve of 14.7% within the worldwide developmental licensed market phase. The U.S. phase has additionally exhibit development, nonetheless to a a lot smaller extent, rising by solely 3.5%. We imagine that such a development price in the long run is probably not sustainable.

However, MCD’s monetary efficiency is barely overshadowed by the non permanent suspension of its operations in Russia and Ukraine. $127 million of prices are related to the suspension, which incorporates worker salaries, lease, and provider funds and in addition stock.

In our view, McDonald’s monetary outcomes are robust, nonetheless there’s an excessive amount of uncertainty surrounding the operations in Russian and Ukraine. In our view, the inventory is at present a “maintain”. Extra readability is required on the length of the suspension of the operations and on potential additional losses because of the geopolitical stress earlier than we will advocate to purchase the inventory.

Allow us to take a look at McDonald’s enterprise to determine, whether or not it could possibly be a great funding as soon as the uncertainty decreases. First, we have to perceive MCD’s publicity to Russia and Ukraine, then we want to check out the agency’s development potentials and dangers, and final however not least its worth.

Publicity to Russia and Ukraine

As of 31.12.2021, MCD had 847 eating places in Russia 84% of which was firm operated. The agency additionally had 108 eating places in Ukraine, which had been all firm operated. These figures could appear excessive, however McDonald’s is the worldwide market chief in foodservice retail with greater than 40,000 areas in additional than 100 nations.

For 2021, Russia and Ukraine gross sales mixed represented solely 2% of the system vast gross sales, nonetheless as a lot as 9% of the income, because of the excessive variety of company-operated eating places within the area. The working earnings from these two nations symbolize solely 3% of the entire.

We imagine that the non permanent suspension of operations in Russia is not going to have a big long-term influence on MCD’s enterprise. Nonetheless, within the short-term important uncertainty exists, together with the potential for reopening the eating places and in addition additional potential losses.

Financials and technique

First quarter outcomes

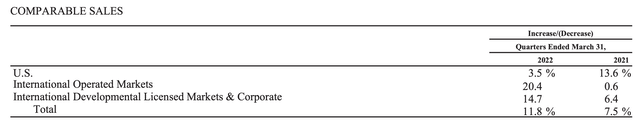

The agency has reported a big improve in comparable gross sales in comparison with the 12 months in the past quarter.

Comparable gross sales (McDonald’s)

Within the U.S., the primary drivers of the gross sales development had been the will increase in menu costs and in addition the expansion within the digital channel.

In our view, each of those parts are essential within the present inflationary setting. The rise in menu costs, along with the expansion in gross sales, proves that McDonald’s is ready to cross over the elevated enter prices to its clients. Additional, the digital channel additionally benefitted from MCD’s launch of “MyMcDonald’s Rewards” final 12 months by enhancing buyer loyalty.

Within the worldwide operated markets, the spectacular efficiency development was primarily enabled by the easing of Covid associated authorities restrictions. Operations in France and the UK contributed considerably.

We imagine that after all of the restrictions are lifted, these development figures should not prone to be sustained. Subsequently, such development figures should not appropriate to construct are funding thesis on.

Within the worldwide developmental licensed market, the leaders of development had been Japan and Brazil, offset by gross sales in China because of the new authorities restrictions launched due to the Covid-19 outbreak.

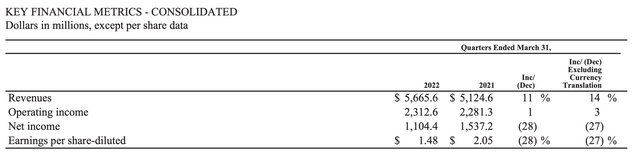

When it comes to diluted EPS, a decline of about 28% could possibly be noticed Y/Y.

Key monetary metrics (McDonald’s)

The drivers of this decline are prices related to the non permanent suspension of the enterprise in Russia and Ukraine, and a reserve put aside for a world tax matter. The influence of those on a per share foundation had been $0.13 and $0.67, respectively.

Technique

In late 2020, the agency has outlined its new technique. In MCD’s annual report they outline their three pillars of development as: maximising advertising and marketing, committing to the core and doubling down on the 3D’s: digital, supply and drive through.

MCD goals to maximise advertising and marketing by speaking their values and the story of their model in a novel, culturally related means. Their dedication to the core means specializing in the hen, beef, and occasional choices on their menu.

We imagine that these two pillars of development should not notably robust and we don’t see important development potential based mostly on these. However, the digital enlargement, with rising variety of deliveries and drive through gross sales could possibly be the driving force of development for the agency, as in 2021 the gross sales by digital channels had been over $18 billion, representing greater than 25% of all systemwide gross sales of their 6 largest markets. Additional, the energy of their digital initiatives is confirmed by the truth that they’ve greater than 30 million customers registered of their MyMcDonald’s Rewards, from which 21 million are actively loyalty members.

Worth

Value multiples

McDonald’s is buying and selling at considerably larger multiples than its friends. Though these multiples could also be barely distorted because of the important diluted EPS decline within the first quarter, we imagine they aren’t justified. Each when it comes to P/E and EV/EBITDA the agency is buying and selling at over a 100% premium in comparison with the sector median. We do perceive that MCD is a market chief and one of the recognised manufacturers on this planet, however its development potential is proscribed. Additional, rising competitors and a world change in the direction of more healthy existence might create headwinds for the agency.

By wanting on the EPS estimates, analysts count on the earnings within the subsequent 4 quarters to be within the vary of $9.05 – $10.61. Precise earnings per share in 2021 had been $9.28, indicating that there’s not a lot development foreseen.

In our view, the agency is at present overvalued and there are significantly better alternate options out there with larger development, and buying and selling at decrease multiples. If you’re on the lookout for development at an affordable value, take a look at our earlier article on Crocs, Inc. (CROX).

Share buybacks

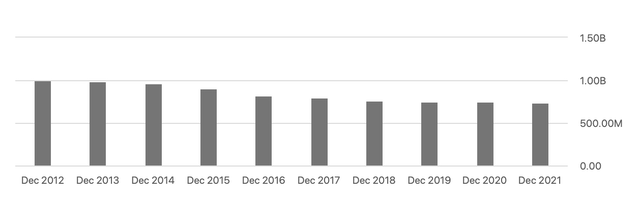

MCD has been constantly shopping for again its shares within the final decade, decreasing their variety of excellent shares by greater than 30%.

Variety of shares excellent (Looking for Alpha)

In our opinion, share buybacks are at all times a good way to return worth to the shareholders in the long run. MCD proves its dedication by its steady share buyback packages.

Dividend

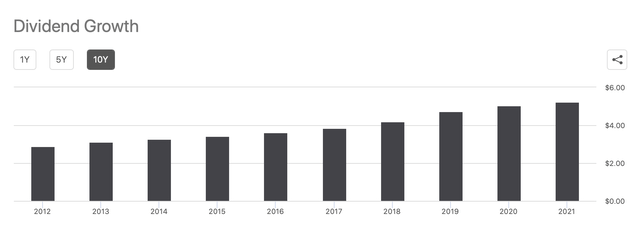

Within the first quarter, the corporate declared a quarterly dividend of $1.38 per share. The present dividend yield of the MCD is barely above 2%.

MCD has a powerful monitor file of returning worth to its shareholders within the type of dividends. Their payouts have been constantly rising within the final 10 years.

Dividend development (Looking for Alpha)

Nonetheless, McDonald’s has a payout ratio of greater than 50%. In comparison with the agency’s 5-year common of 75% payout this appears low, nonetheless it is greater than double the sector median of about 25%.

In our view, a payout ratio over 50% is just too excessive. There are different companies, which have the same dividend yields and development as MCD, however having a a lot decrease payout ratio. If you’re on the lookout for sustainable dividends, there are higher alternate options out there. If you’re concerned about another, examine our earlier article on Tyson Meals, Inc. (TSN).

Dangers

Lastly, allow us to spotlight among the dangers that we imagine are essential to grasp, earlier than investing in MCD’s enterprise. An in depth record of the dangers will be present in McDonald’s annual report.

1.) Change of buyer preferences

We imagine that at present many individuals are aiming for a more healthy way of life, which can create headwinds for MCD, at the least in sure segments of the inhabitants. However, we imagine that MCD is continually rising its choices to attempt to accommodate these developments e.g. by partnering with Past Meat (BYND) to supply meat free burgers in plenty of eating places.

2.) Extremely aggressive market

Though MCD is among the largest and most recognised manufacturers on this planet, altering developments and newly showing eating places can eat away market share from MCD.

Our takeaways

McDonald’s had stable monetary figures within the first quarter of 2022, whatever the influence by the geopolitical stress in Jap Europe.

The profitable implementation of the technique is essential for future development. Promising indicators in digital will be already seen.

MCD seems to be overvalued based mostly on a number of metrics and its dividend payout ratio of fifty% is just too excessive for our style.

Await a drop in value earlier than beginning a brand new place.